Recording settlement discounts on sales

For all sales transactions which haven't been fully paid, the VAT is now calculated at the full value of the invoice. When a customer pays within the settlement period, you will need to enter adjustments to account for the VAT discount taken by the customer.

Invoices and orders

Record sales invoices

When you record the details of an invoice in Sage 200 that has been produced elsewhere, the details you record must match the details printed on the invoice and sent to the customer.

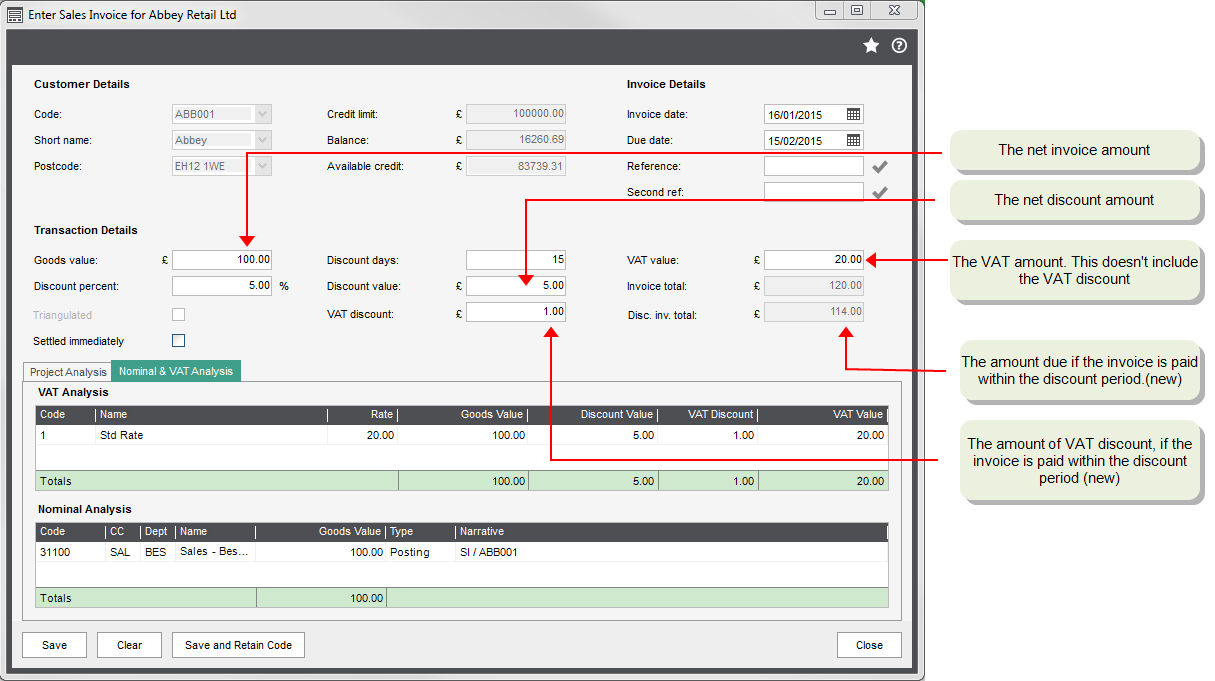

If the invoice hasn't been paid, the VAT should be calculated at the full goods value before the discount. When you record the invoice, Sage 200 will calculate the VAT at the full rate, by default. For invoices with settlement discounts, you can also enter the following additional values: Discount %, Net Discount, VAT Discount.

Depending on the values entered, the Invoice total and Discounted invoice total are calculated. The Disc Inv Total is the amount that you expect to be paid within the discount period.

You can change the values as required. Don't forget - the totals in the VAT Analysis section must match the values in the Transaction Details.

For an invoice of £100 with a 5% settlement discount, the following values are calculated:

- VAT = 20.

- Discount value = 5.

- VAT discount = 1.

- Invoice total = 120.

- Discounted value = 114.

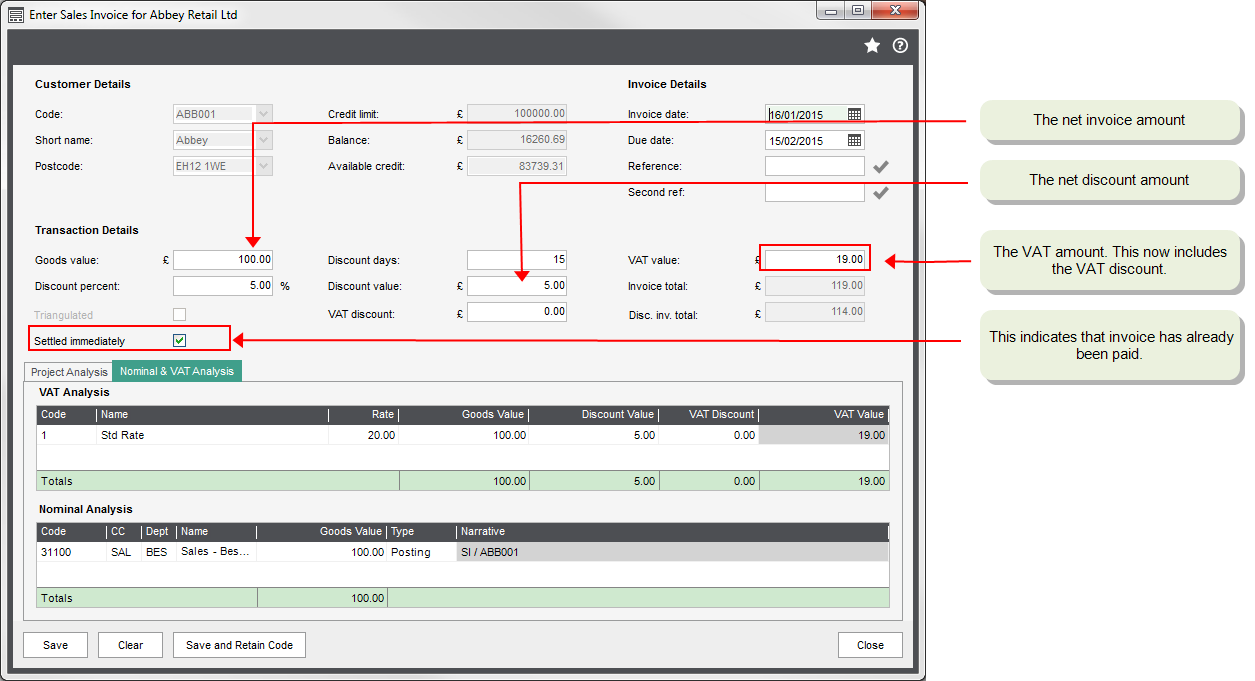

If the invoice has been paid straight away, the settlement discount will have been taken. The VAT on the invoice sent to the customer will already be discounted.

When you record this invoice in Sage 200, select the Settled immediately check box. This tells Sage 200 to calculate the VAT on the discounted invoice amount. In this case there is no need to process an adjustment to account for the VAT discount.

For an invoice of £100 with a 5% settlement discount, the following values are calculated:

- VAT = 19.

- Discount value = 5.

- VAT discount = 0.

- Invoice total = 119.

- Discounted value = 114.

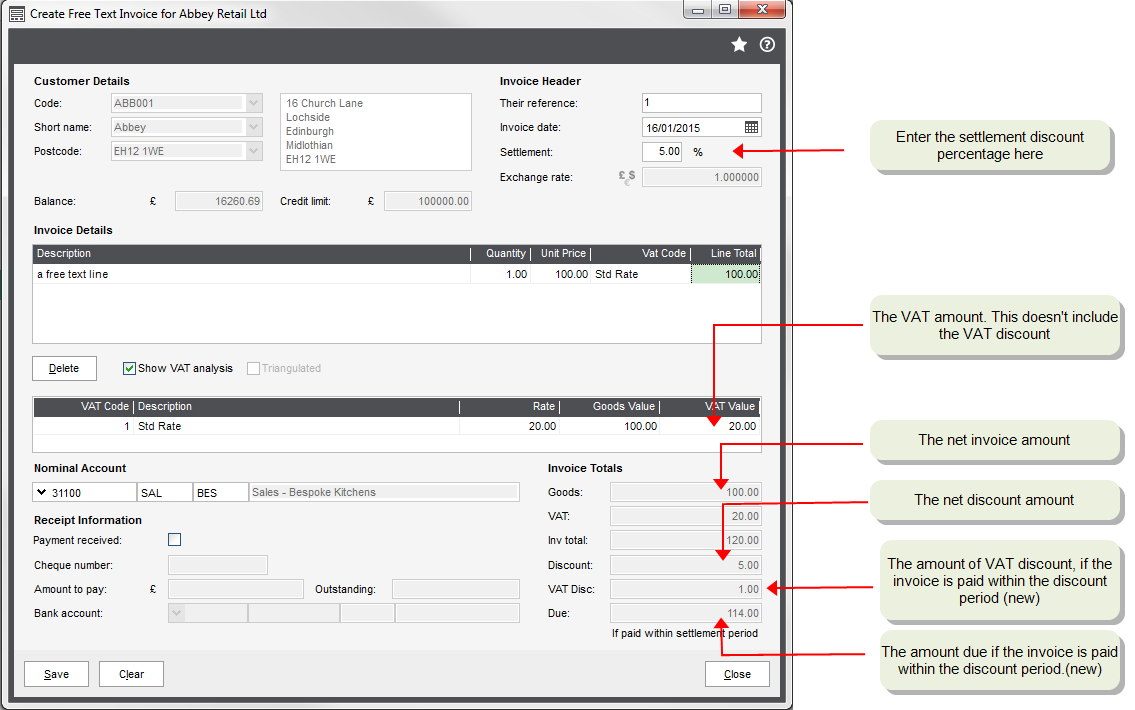

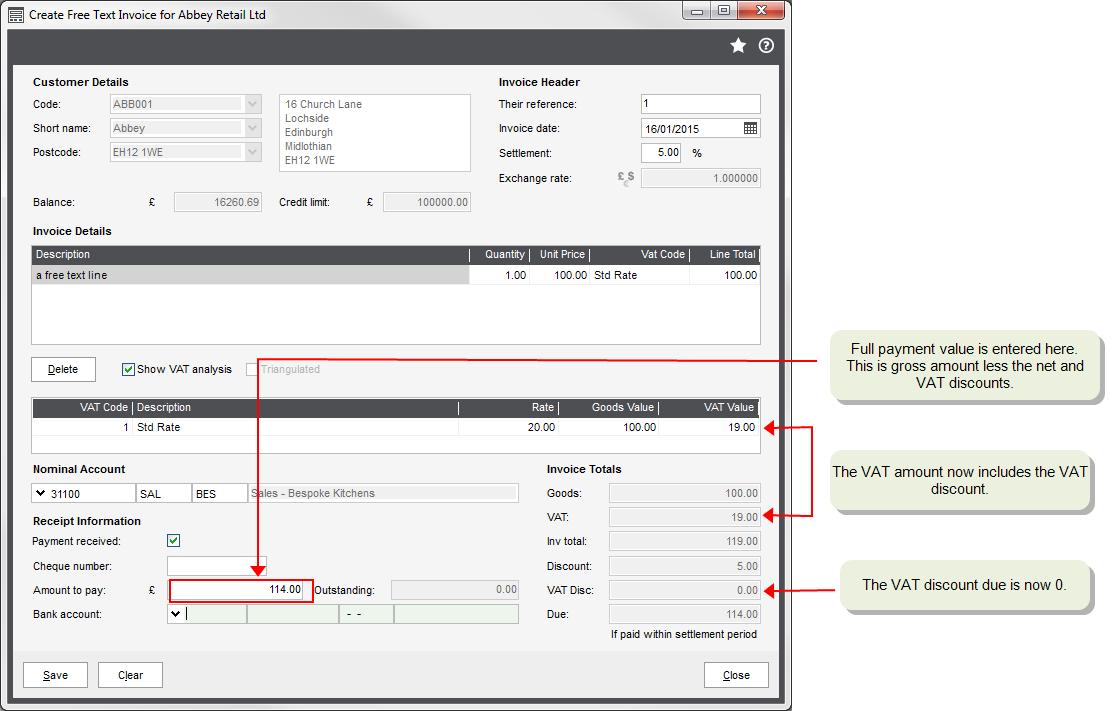

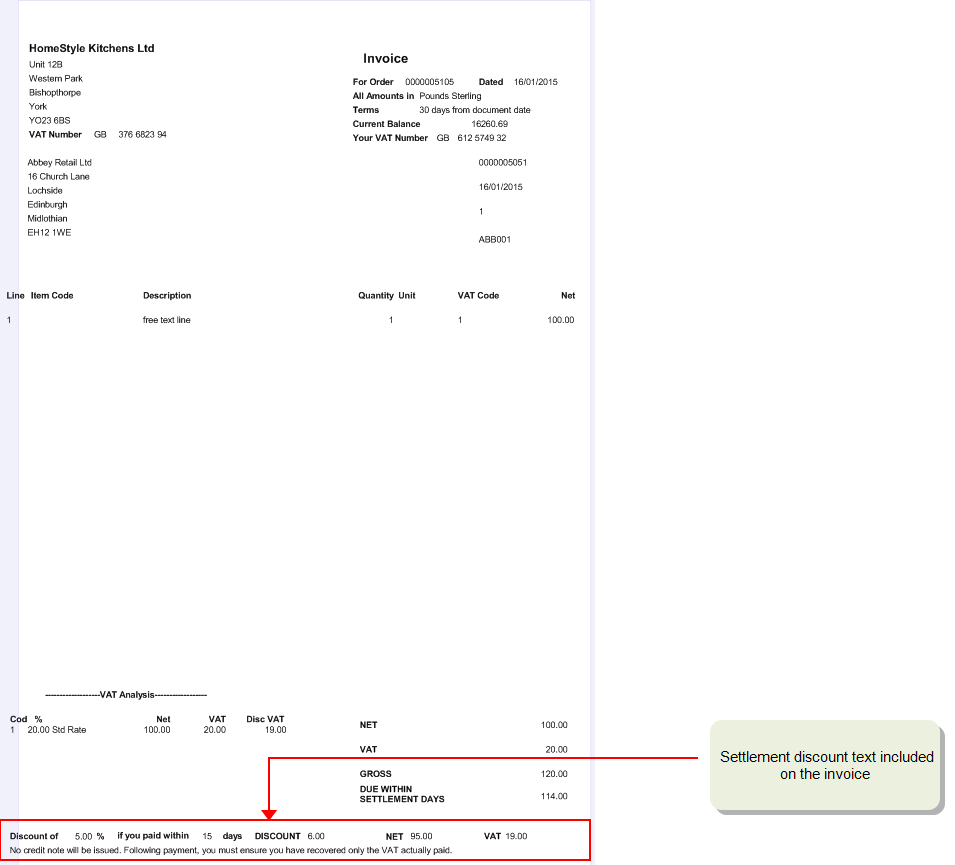

Free text invoices

The settlement discount percentage is entered on the invoice. Sage 200 calculates the VAT for the full amount of the invoice, before settlement discount is applied. When the invoice is printed, the amount of discount (net and VAT) that can be claimed if the invoice is paid early, as well as the full amount (net and VAT) due after the settlement discount period is stated on the invoice. This means that there is no need to issue an additional VAT only credit note, if the customer pays within the discount period. However, internal VAT adjustments will be required.

When you enter a full payment with a free text invoice, the net and VAT discounts are automatically applied and used to calculate the payment amount. In this case there is no need to process an adjustment to account for the VAT discount. If you enter a part payment, the VAT is calculated at the full amount.

For an invoice of £100 with a 5% settlement discount, the payment amount is £114: the gross amount (£120) minus the net discount (£5) and the discounted VAT (5% x 20 = £1).

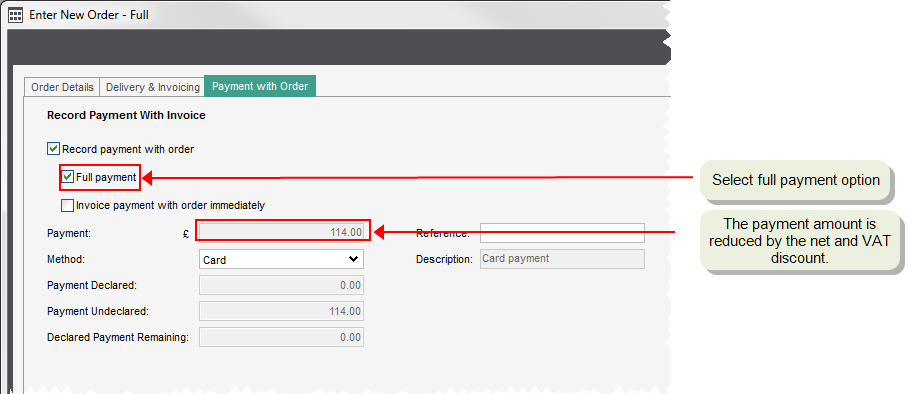

Sales orders and project bills

When invoices are produced from Sage 200, if you're using sales orders or project bills, each invoice states the amount of discount (net and VAT) that can be claimed if the invoice is paid early, as well as the full amount (net and VAT) due after the settlement discount period. This means that there is no need to issue an additional VAT only invoice, if the customer pays within the discount period. However, internal VAT adjustments will be required.

When creating sales order and project bills, you enter the amount of settlement discount on the Delivery and Invoicing tab of the order or bill. When the invoice is printed, Sage 200 calculates the VAT for the full amount before settlement discount is applied, and adds the required text to the invoice.

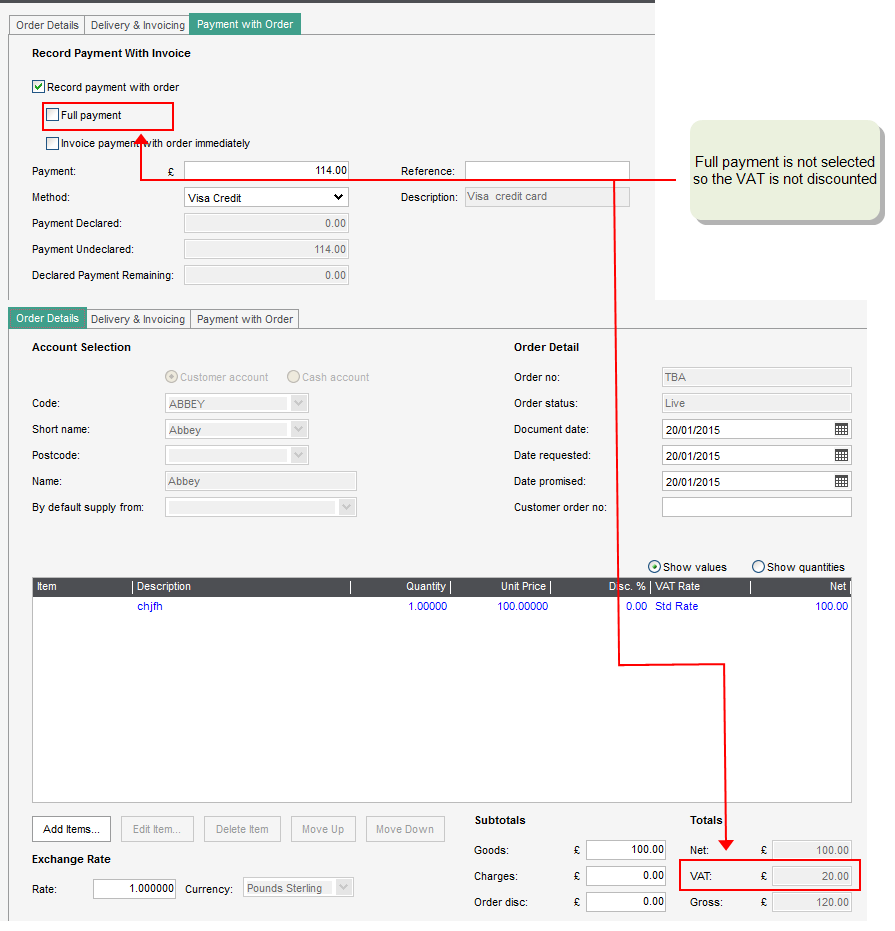

When you enter a full payment with a sales order with settlement discount, the net and VAT discounts are automatically applied and used to calculate the payment amount. In this case there is no need to process an adjustment to account for the VAT discount.

Note: You must select Full Payment when entering the payment details. If you just enter the payment amount, it's treated as a part payment and the discount is not applied.

Receipts

Before you can process a receipt for a customer offered a settlement discount, we recommend that you establish whether the money you've received represents the full payment with no settlement discount, full payment with a discount or a part payment.

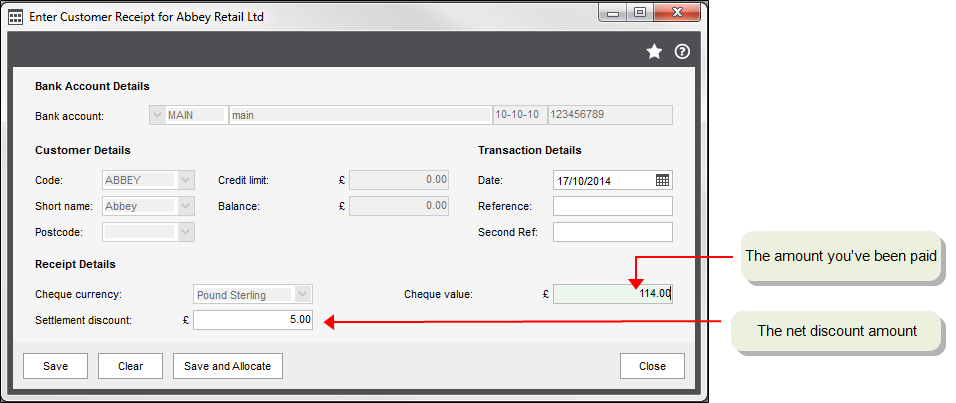

If the customer has taken the discount, you'll need to record the receipt plus the net discount amount. This makes sure that the net discount is posted to the Discounts Allowed nominal account.

-

Record the receipt and include the net discount amount, but not the discounted VAT.

For a payment of £114 with net discount of £5, a transaction is posted for £119. The net discount is posted to the Discounts Taken nominal account.

-

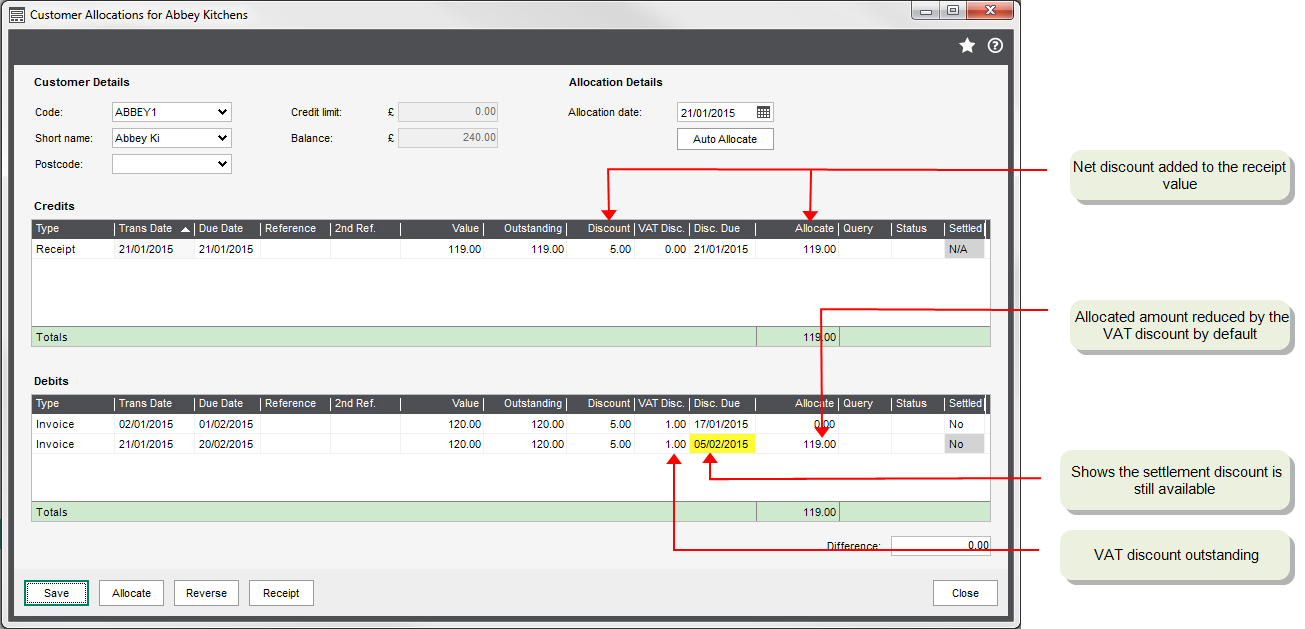

Allocate the receipt to the invoice.

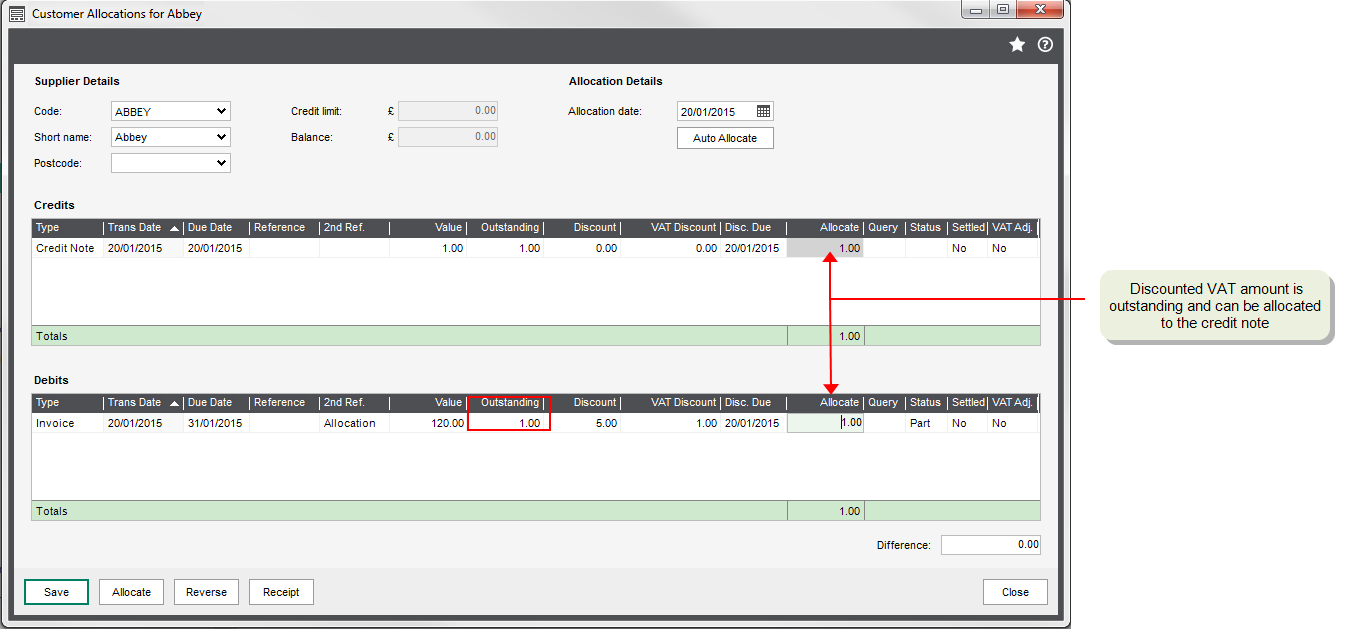

Make sure the allocated amount of the invoice matches the receipt amount. The discounted VAT amount will remain outstanding.

If the settlement discount is still valid, the Disc due is highlighted yellow on the allocation screen. The Allocate amount will default to the payment plus the net discount.

For a payment of £114 with a net discount of £5, the default Allocate amount is £119.

If you use the Auto Allocation option, the Allocate amount is automatically reduced by the VAT discount as long as it's not part paid.

If the settlement discount is no longer valid, the full invoice value is allocated by default.

Enter adjustments to account for the VAT discounts

Once you've entered and allocated payments received from customers taking settlement discounts, the discounted VAT amount will remain outstanding on the customer's account and the full VAT amount will be recorded on your VAT return.

To make sure the VAT is recorded correctly on your VAT return and to clear the outstanding balance on your customer's account, you'll need to process a credit note for the remaining VAT discounts.

How you record these VAT adjustments depends on the business processes you want to use. You may want to process them per invoice or enter a number of adjustments as one transaction for a customer.

We recommend that you process these adjustments before any credit control activities.

-

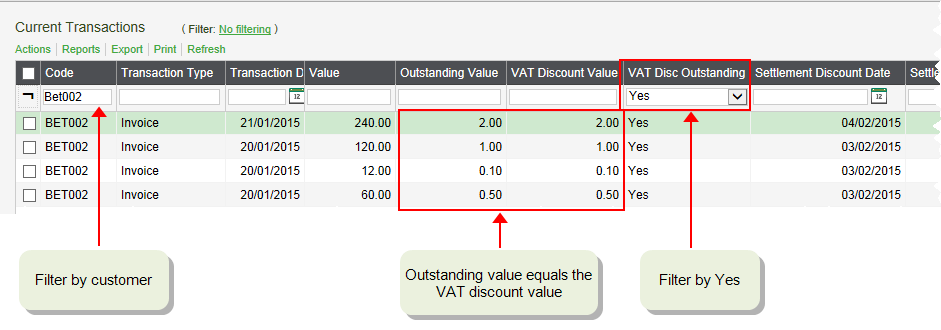

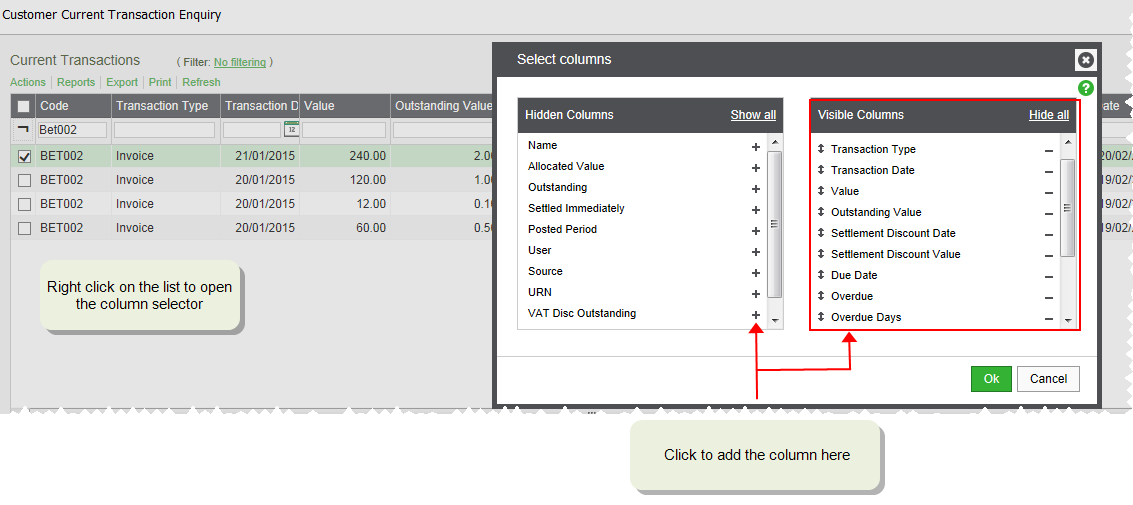

Use the Customer Current Transaction Enquiry workspace to find the transactions that require adjustments for each customer.

See how to do thisThis workspace has two new columns for settlement discount: VAT discount value and VAT Disc Outstanding column. If you filter the VAT Disc Outstanding column by Yes, then only invoices where the outstanding amount is equal to the VAT discount amount are shown.

You can further filter the workspace by customer to see which invoices have the VAT discount outstanding. Use this to calculate the value of the VAT discount you need to credit for the customer.

-

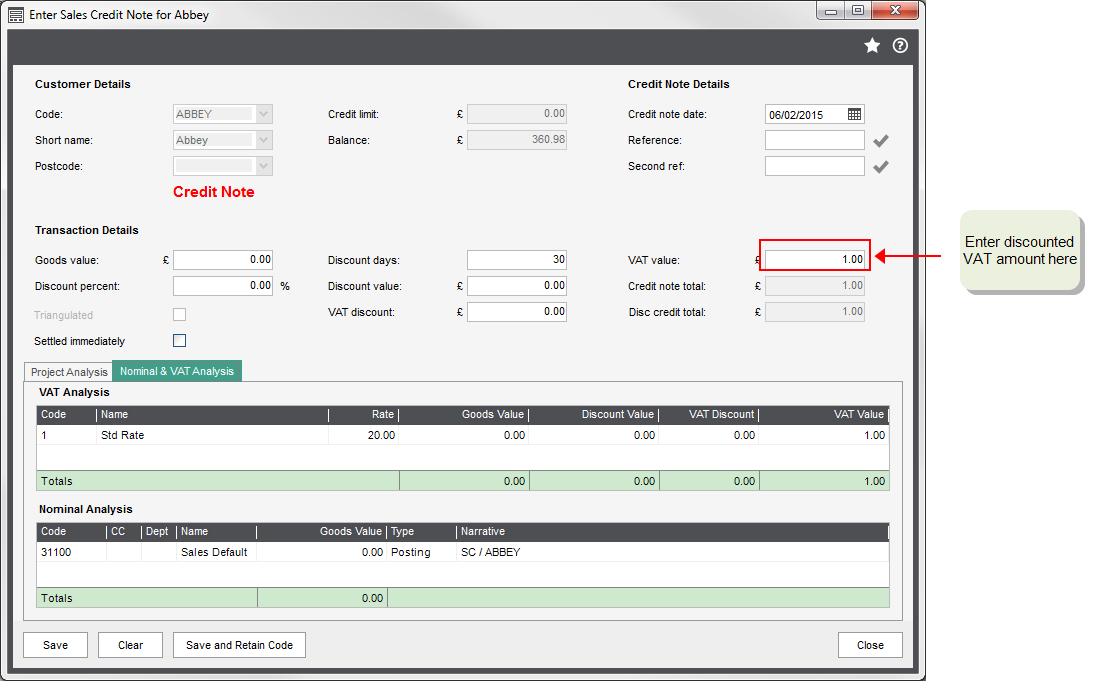

Enter a credit note for the discounted VAT amount. You can do this for individual transactions or as a single transaction for a customer. This makes sure that the VAT is reported correctly on your VAT return.

-

Allocate the credit note to the remaining balance on the invoice(s).

Other things to consider

If you need to reverse a transaction with settlement discount, or you refund a customer, remember to reverse all the elements of the transaction that you've entered into Sage 200:

-

If you recorded the discount amount when you entered the receipt, then the discount amount will have been posted to the Discounts Allowed nominal account. If you want to reverse this when you record a refund, enter the net discount amount on the Payment screen.

- If you recorded a VAT adjustment to account for the VAT discount, you'll need to create a VAT only invoice to reverse this.

Note: When you use the Reverse transaction options, all values on that transaction are automatically reversed. For example, if the invoice contained settlement discount then the reverse credit note will also contain the settlement discount.

You raise an invoice for £100 with 10% early settlement discount. The customer takes the discount and pays you £108 including the VAT discount for £2. You enter VAT only credit note for the VAT discount.

At a later date you need refund the customer. To do this:

- Create a credit note for £100 with 10% settlement discount.

- Record a refund for £108 and enter £10 as the discount amount on the Payment screen.

- Allocate the credit note to the refund leaving £2 outstanding.

- Create a VAT only invoice for £2 and allocate it to the outstanding balance on the credit note.

We recommend that you don't use Balance Forward for accounts where you offer a settlement discount. This is because the discount details are lost when individual transactions are replaced with the brought forward balance.

You can additionally import the VAT discount value and flags for Settled Immediately and VAT Disc Document Expected.

New default invoice and credit note layouts have been included which contain the additional text and fields required by HMRC for invoices that contain settlement discount. You'll need to make sure that your custom layouts also contain this text and the additional fields. We recommend that you customise the new default layouts.

Example

You offer a settlement discount of 5%.

- You record the details of an invoice for £100. VAT is calculated at £20. You enter the discount percentage and amount which is £5.

-

You receive payment for the invoice within the specified period and the customer has taken the discount, so they pay you £114. This is the gross amount (£120) minus the net discount (£5) and the discounted VAT (5% x 20 = £1).

- You record the receipt and enter the cheque value as £114 and add the discount value as £5. This creates a transaction value of £119.

- You allocate the invoice (£120) to the receipt (£119). The VAT discount of £1 is still outstanding

- You create a credit note for the VAT discount of £1.

- You allocate this to the remaining balance on the invoice.

The following values are posted to the nominal ledger:

| Transaction | Nominal Account | Debit | Credit |

|---|---|---|---|

| Invoice | Debtors Control | 120 | |

| Net | 100 | ||

| VAT | 20 | ||

| Receipt | Discounts Allowed | 5 | |

| Bank Account | 114 | ||

| Debtors Control | 119 | ||

| Credit Note | Debtors Control | 1 | |

| VAT | 1 |

Sage is providing this article for organisations to use for general guidance. Sage works hard to ensure the information is correct at the time of publication and strives to keep all supplied information up-to-date and accurate, but makes no representations or warranties of any kind—express or implied—about the ongoing accuracy, reliability, suitability, or completeness of the information provided.

The information contained within this article is not intended to be a substitute for professional advice. Sage assumes no responsibility for any action taken on the basis of the article. Any reliance you place on the information contained within the article is at your own risk. In using the article, you agree that Sage is not liable for any loss or damage whatsoever, including without limitation, any direct, indirect, consequential or incidental loss or damage, arising out of, or in connection with, the use of this information.